Difference in Fdi Explain Japan Ireland

FDI Inflow Differences In 2008 inward FDI accounted for some 637 percent of gross fixed capital formation in Ireland but only 41 percent in Japan gross fixed capital formation refers to investments in fixed assets such as factories warehouses and retail stores. On the other hand FPI Foreign Portfolio Investment represents passive holdings of securities such as foreign stocks bonds or other.

Foreign Direct Investment Fdi Overview Benefits Disadvantages

Both FDI and FPI involve the acquisition of a stake in an enterprise which is domiciled in another country.

. Corporations are allowed to enter in another country with the intention of establishing a lasting. Based on figures for 2003 Japans ratio of inward FDI to outward FDI was 027. Retrieved from Do some research on Japan.

Both FDI Foreign Direct Investments and FII Foreign Institutional Investments relate to foreign investments made by an entity based in another country. The CSO publishes values of FDI using two internationally agreed methods. Foreign Institutional Investors FIIs are large companies that invest in countries other than where their headquarters are located.

The pattern of Japanese FDI flows into Ireland is analysed in the context of Irelands determinants of FDI competitive advantage. A foreign direct investment happens when a corporation or individual invests and owns at least ten percent of a foreign company. Future considerations around Irelands model of competitive.

Ireland has a well-educated relatively low cost workforce and an abundant supply of labor while Japans workforce also well-educated is expensive. This compares to ratios for the US Britain Germany and France of between 06 and 09. Consequently direct investors may be more committed to managing their international investments and less likely to pull out at the first sign of trouble.

FDI Inflow Differences In 2008 inward FDI accounted for some 637 percent of gross fixed capital formation in Ireland but only 41 percent in Japan gross fixed capital formation refers to investments in fixed assets such as factories warehouses and retail stores. FDI has been identified as one of the key factors that has spurred the growth of the Celtic Tiger. The investing companies get favorable dealsresources workforce facilities land.

Demographics also help explain Japans outward foreign-direct investment. On the contrary FPI connotes a route to funds into a nation where foreign residents can buy securities from the countrys stock or bond market. FDI is more difficult to pull out or sell off.

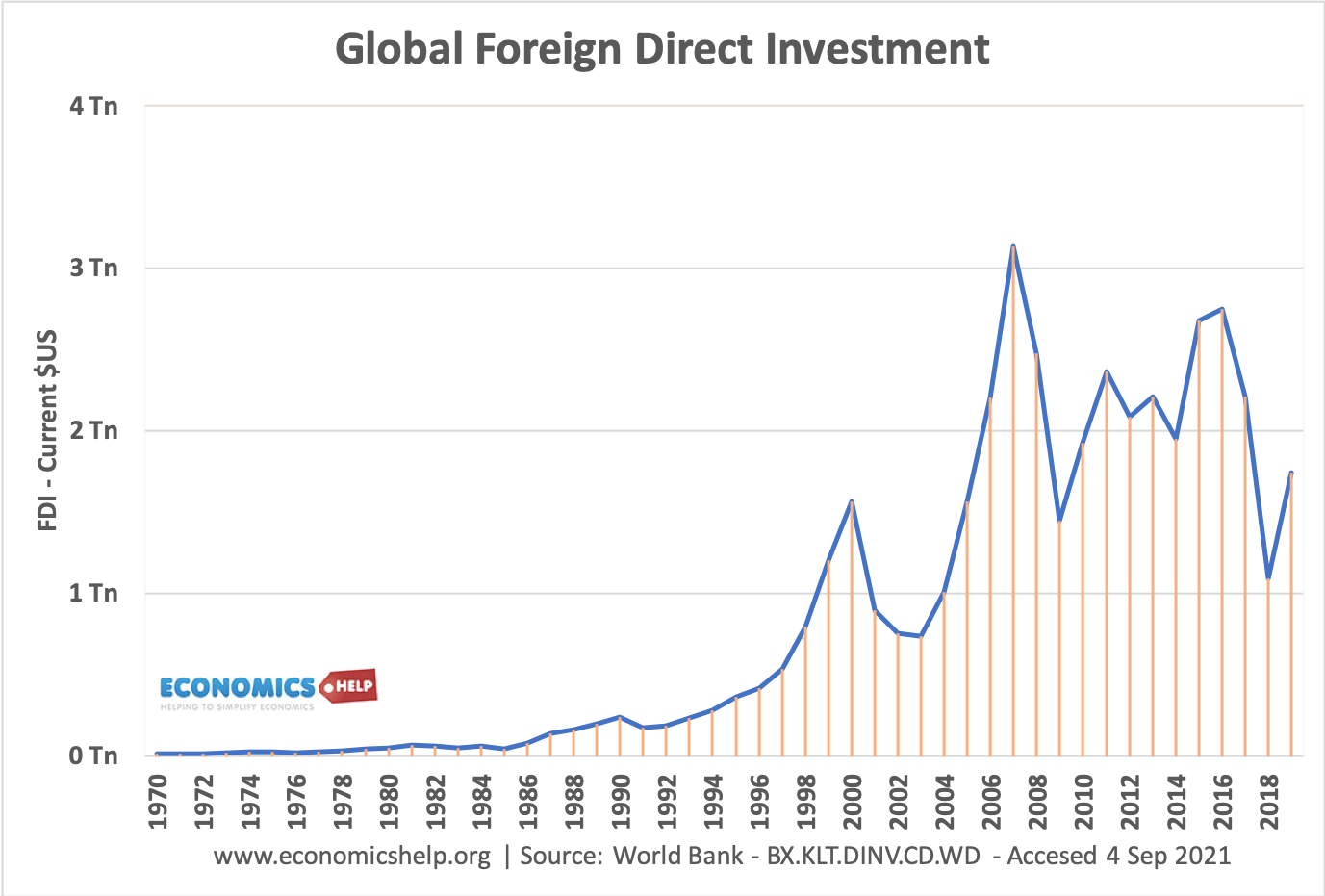

One in four people in Japan will be older than 65 in 2014 compared with 96 percent in China and 142 percent in the US. He invests this creating a new clothing manufacturing firm. The flow of FDI had slowed down due to the global economic crisis and they started to pick up again at a slow rhythm.

An adaptation of Porters Diamond is offered to explain the determinants of Irelands competitive advantage in attracting FDI. Many developing countries need FDI to facilitate economic growth or repair. This is an important topic for the Indian economy segment of the UPSC syllabus.

The BEA tracks US. In addition to the funds the investment includes technology equipment raw materials knowledge and management skills. Trade data is typically split between trade merchandise and trade in service.

According to the UNCTAD report on world investment Japans potential appeal for foreign investment is very strong compared to the other countries of the world but its performance in terms of reception of FDI is weak. Foreign direct investment FDI is where an individual or business from one nation invests in another. The Current Affairs page will help you keep track of the latest.

FDI basically means to invest in a foreign company and to acquire controlling ownership in that company and on the other hand FII means investing in the foreign stock market. In 2008 inward FDI accounted for some 637 percent of gross fixed capital formation in Ireland but only 41 percent in Japan gross fixed capital formation refers to investments in fixed assets such as factories warehouses and retail stores. For instance Mr Bloggs from the US has 1 million and wants to start a new company in Germany.

The first index compares inward FDI with outward FDI. Unlike FDI FPI doesnt offer control over the business entity in which the investment is made. According to the WTO global merchandise trade declined 3 in 2019 while trade in commercial services rose 21.

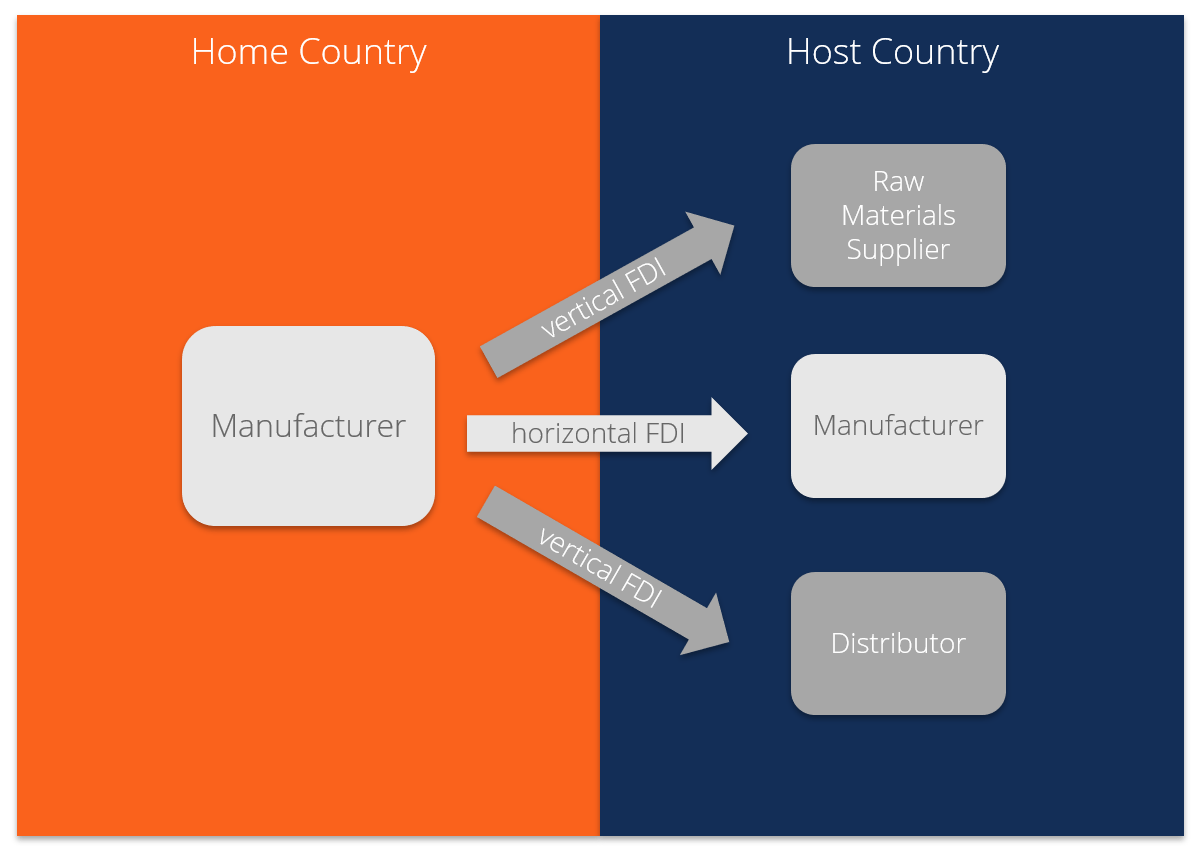

But these two differ in nature of holdings term the degree of control etc. Foreign Direct Investment FDI. Internalization theory Vernons product life cycle theory and Knickerbockers theory of FDI.

This article addresses Irelands record in attracting foreign direct investment FDI. This publication is intended to supplement the CSOs current publications on Foreign Direct Investment FDI in Ireland and explain any differences found between FDI figures published by the CSO or other international organisations. Integration including the experience of the Eu ropean Unions single market.

The case of FDI of Japanese companies inflows in the ASEANs automotive industry will be studied to explain the potential impact of the FDI inflows as the FDI of Japanese companies into this industry has the highest share in the manufacturing sector in ASEAN. Foreign direct investment FDI is an investment made by a company or individual in one country in business interests in. Furthermore a FDI result in the transfer of capital resources technology knowledge expertise and human capital whereas FII generally transfers funds only.

2 When an American tech company opens a data center in India it makes an FDI. Foreign direct investment FDI is an investment made by a company or an individual in one country into business interests located in another country. Do some research on Japan and Ireland.

What is Foreign Direct Investment FDI. The term FII is most commonly used in India where it refers to outside entities investing in the nations. Foreign direct investment FDI is a strategy for contributing funds and resourcesto establish business units in foreign countries.

This could be to start a new business or invest in an existing foreign owned business. FDI is given preference over FII because it helps in the economic growth of the country. FDI is an important driver of economic growth.

We can thus see that Japans inward FDI is extremely low compared to its outward FDI. Foreign Direct Investment - FDI. They rose by 102 and 84 respectively the previous year.

Many of us are generally confused about FDI and FII. Visit the MSU globalEDGE website. Compare and contrast these explanations of FDI.

UNCTAD data shows global FDI flows rising 3 in 2019 following steep declines in 2017 and 2018. Foreign direct investment FDI is an investment from a party in one country into a business or corporation Corporation A corporation is a legal entity created by individuals stockholders or shareholders with the purpose of operating for profit. Explain the difference in FDI inflows.

Come lets understand the difference. The overall trends in FDI inflows to Ireland are considered.

What Is Foreign Direct Investment Fdi Yadnya Investment Academy

The Quest For Fdi Visual Ly Investing Infographic Investment House

World Investment Report Chapter 1 Global Trends And Prospects

No comments for "Difference in Fdi Explain Japan Ireland"

Post a Comment